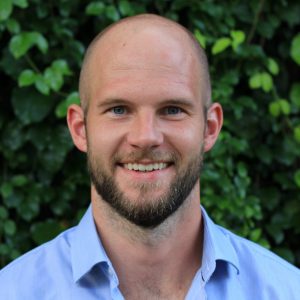

GoTo Group undertook a massive leadership shakeup in June 2023 that saw Northstar Group managing partner Patrick Walujo taking over as the new CEO. In the driver’s seat, Walujo is widely expected to prepare the Indonesia-listed tech giant for a faster move toward profitability and an eventual US public offering.

After assuming charge, Walujo’s main focus has been on cost-cutting measures, driving synergies, and shutting down non-core divisions. In a landmark deal, GoTo agreed to sell a 75.01% stake in its e-commerce division Tokopedia to TikTok — the ByteDance-owned short video app whose social commerce business, TikTok Shop, was shuttered in September following a ban on social commerce. TikTok has committed to invest over $1.5 billion into the enlarged Tokopedia.

In the keynote chat at the summit, Patrick Walujo, who is also an early investor in Gojek, will dwell on the challenges of managing heated competition from rivals, on one hand, and investor expectations on the other.

GoTo CEO also wears the hat of Co-Founder and Co-Managing Partner of the Northstar Group, a Singapore headquartered private equity and venture capital firm.

Since its founding in 2003, the Northstar Group has raised five private equity funds and a venture capital fund and is now one of the largest private investors in Southeast Asia. The Northstar Group focuses on Indonesia with a current strategy of investing in the financial services, consumer and digital economy sectors.