8:00am – 9:00am | Sustainable Impact: Entrepreneurial Solutions to Environmental Challenges

- Handhi Kentjono, Co-CEO, Manna Agribio

- Philippe Micone, CEO, Noovoleum

- Tika Diagnestya, Director of, Sustainability and Impacts, Nafas Group

- Justin Patrick, Director, Rigel Capital (Moderator)

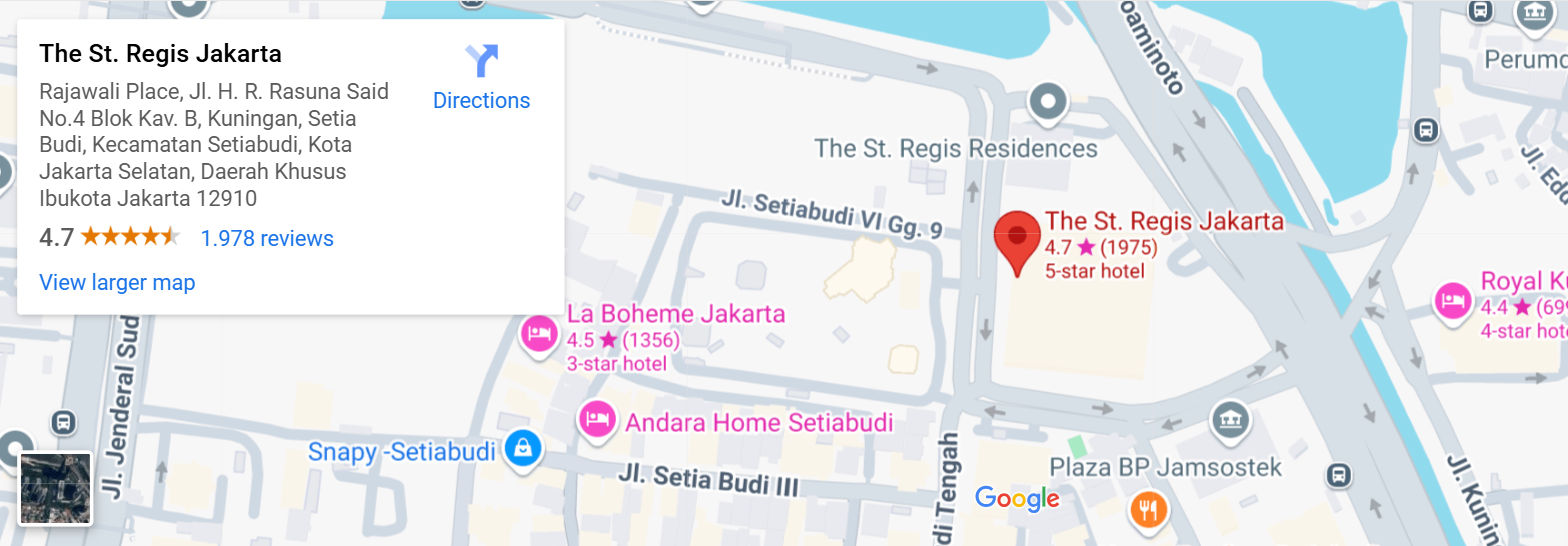

Location: Newport 1, The St. Regis Jakarta

[Sponsored by Rigel Capital]

12:45pm – 1:45pm | Connecting SE Asian firms with global capital in HK as IPO window reopens in 2025 – Opportunities & Perspectives

- Rita Lau, Director, Equity Capital Markets (Southeast Asia), CLSA

- Mandy Wong, Partner, Latham & Watkins

- Katherine Ng, Head of Listing, HKEX

- Eudora Wang, Deputy Editor, Greater China, DealStreetAsia (Moderator)

Location: Newport 1, The St. Regis Jakarta

[Sponsored by HKEX]

12:45pm – 1:45pm | Digital Indonesia: Uninvestable No More

- Dmitry Levit, Founder & General Partner, Cento Ventures

- Ali Fancy, Partner, Cento Ventures

- Ronald Kang, Investor Relations, Cento Ventures

- Andi Haswidi, Head of Data Research, DealStreetAsia (Moderator)

Location: Newport 2, The St. Regis Jakarta

[Sponsored by Cento Ventures]