Asia PE-VC Summit 2022

27 & 28 September 2022

Sofitel Singapore City Centre

Speakers

EXCLUSIVE!

Virtual Session Speakers

Virtual Sessions are exclusively curated pre-recorded sessions and will only be sent to participants with a valid registration for the Asia PE-VE Summit 2022 in Singapore. These content sessions will be sent via email, post-event, to registered participants only. These sessions are not sold individually at a separate price for viewing.

Register for the Asia PE-VC Summit 2022 now to get access to both in-person and virtual sessions!

Moderators

Agenda

8:00 am – 9:00 am | Registration & Morning Networking

9:00 am – 9:15 am | Welcome note

by Joji Thomas Philip, Founder & Editor-in-Chief, DealStreetAsia

9:15 am – 10:00 am | How is private equity in Asia riding the downcycle?

- Kenneth Cheong, Managing Director, Baring Private Equity Asia Pte Ltd

- Nainesh Jaisingh, Founding Partner & CEO, Affirma Capital

- Eddie Ong, Deputy Chief Investment Officer & Managing Director (Private Investments),

- SeaTown Holdings

- Doug Coulter, Partner, Head of Private Equity, Asia-Pacific, LGT Capital Partners

- Deepshikha Monga, Editor, DealStreetAsia (Moderator)

10:00 am – 10:30 am | Fireside Chat: The LP View – Investing in Asia: Opportunities in

the largest markets and beyond

- Francois Pictet, Managing Partner, Pictet Group

- In conversation with Michelle Teo, Managing Editor, DealStreetAsia

10:30 am – 11:00 am | Networking and Coffee break

11:00 am – 11:30 am | Fireside Chat: Post-pandemic, has edtech in India fallen out offavour?

- Ronnie Screwvala, Co-Founder & Chairperson, Upgrad

- In conversation with Joji Thomas Philip, Founder & Editor-in-Chief, DealStreetAsia

11:45 am – 12:30 pm | The LP View: Backing emerging market and first-time managers in

- Soo Yar-Ping, Partner, Primary Investments, Adams Street Partners

- Huai Fong Chew, Regional Lead, East Asia & the Pacific PE Funds, IFC

- Dave Richards, Managing Partner, Capria Ventures

- Sarah Chen, Co-Founder and Managing Partner, Beyond The Billion (launched as The

- Billion Dollar Fund for Women)

- Tsubasa Suruga, Staff Writer, Nikkei Asia (Moderator)

12:30 pm – 1:20 pm | Lunch Networking

1:20 pm – 2:00 pm | Time for private credit to shine in Asia

- Denny Goenawan, Managing Partner, Indies Capital Partners

- Wei Hsien Chan, Managing Director, Seatown Holdings

- Nitish Agarwal, CEO and CIO, Orion Capital Asia

- Matthew Michelini, CEO, Apollo Asia-Pacific

- Justin Ferrier, Managing Partner, Private Credit, Navis Capital Partners (Moderator)

2:00 pm – 2:45 pm | Values vs value: Scaling impact through private capital

- Chik Wai Chiew, CEO and Executive Director, Heritas Capital

- Mahesh Joshi, Head, Private Equity Investment Asia, BlueOrchard Finance

- Ivan Kwong, Principal, KKR & Co. Inc.

- Utari Octavianty, Co-Founder and Chief Sustainability Officer, Aruna

- Michelle Teo, Managing Editor, DealStreetAsia (Moderator)

2:50 pm – 3:35 pm | PEs & VCs compete on the same turf with rising growth funds and

- Vadim Shpak, Operating Managing Director, Vickers Venture Partners

- Shilpa Kulkarni, Founder and Managing Partner, Panthera Growth Partners

- Sunil Thakur, Partner, Quadria Capital

- Anupum Khaitan, Executive Director, Capital Square Partners (Moderator)

3:35 pm – 4:00 pm | Networking and Coffee break

4:00 pm – 4:40 pm | Is the time ripe for secondaries as IPOs and trade exits turn cold?

- Paul Robine, Founder & CEO, TR Capital

- Michael Liu, Managing Director, Portfolio Advisors

- Desmond Lee, Managing Director, NewQuest Capital Partners

- Jason Sambanju, Partner, CEO & Founder, Foundation PE (Moderator)

4:40 pm – 5:25 pm | What makes PE investors bet on SE Asia’s macro story?

- Bert Kwan, Head of Private Equity, Silverhorn

- Kerry Goh, CEO and Chief Investment Officer, Kamet Capital

- Dr Thomas Lanyi, Head Southeast Asia, CDH Investment Advisory Private Limited

- Wei Jian TOR, Managing Director, EQT Private Equity

- Andrea Campagnoli, Partner, Bain & Company (Moderator)

5:30 pm – 6:00 pm | Private equity in Asia: What’s the next big play?

- Ravi Thakran, Ex Group Chairman, LVMH Asia

- In conversation with Joji Thomas Philip, Founder & Editor-in-Chief, DealStreetAsia

6:00 pm – 7:30 pm | Networking and Cocktails

8:00 am – 9:00 am | Registration & Morning Networking

9:00 am – 9:15 am | Welcome address

by Joji Thomas Philip, Founder & Editor-in-Chief, DealStreetAsia

9:15 am – 9:45 am | Opening Keynote: Have we hit the bottom? Where do we go from

by Nick Nash, Co-Founder and Managing Partner, Asia Partners

9:45 am – 10:30 am | VCs have a diversity problem. What can they do to bridge the gap?

- Rishika Chandan, Managing Director, Venturi Partners

- Pinn Lawjindakul, Partner, Lightspeed Venture Partners

- Cristina Ventura, General Partner & Chief Catalyst Officer, White Star Capital

- Deepshikha Monga, Editor, DealStreetAsia (Moderator)

10:30 am – 11:00 am | Networking and Coffee break

11:00 am – 11:45 am | Are early-stage deals still hot amid funding winter?

- Anup Jain, Managing Partner, Orios Venture Partners

- Avina Sugiarto, Partner, East Ventures

- Khailee Ng, Managing Partner, 500 Global

- Jennifer Ho, Partner, Integra Partners

- Andi Haswidi, Head of ASEAN Research, DealStreetAsia (Moderator)

11:45 am – 12:30 pm | Build local, think global: The opportunity for cross-border SaaS

- Kabir Narang, Founding General Partner, B Capital Group

- Cyrus Driver, Managing Director, Partners Group

- Nishant Rao, Founding Partner, Avataar Venture Partners

- Mohan Kumar, Managing Partner, Avataar Ventures (Moderator)

12:30 pm – 1:30 pm | Lunch Networking

1:30 pm – 2:00 pm | Fireside chat: Capturing value in a downturn as private market

valuations hit correction course

- Jenny Lee, Managing Partner, GGV Capital

- In conversation with Joji Thomas Philip, Founder & Editor-in-Chief, DealStreetAsia

2:00 pm – 2:50 pm | Fintech in SE Asia turning into an ecosystem play. What next?

- Juliet Zhu, Group President & CFO, CARSOME

- Julian Tan, Founder & CEO, FastCo

- Ganesh Rengaswamy, Co-Founder & Managing Partner, Quona Capital

- Darius Cheung, CEO, 99.co

- Nicholas Smalle, Partner, Apis Partners

- Ali Fancy, Partner, Cento Ventures (Moderator)

2:50 pm – 3:25 pm | The future of Warung/Kirana tech in India and SE Asia

- Smita Aggarwal, Global Investments Advisor, Flourish Ventures

- Abhinay Peddisetty, Co-Founder & CEO, BukuWarung

- Arvind Sankaran, Founder, Imaginarium Advisors

- Visa Kannan, Partner, Saison Capital (Moderator)

3:25 pm – 3:50 pm | Networking and Coffee break

3:50 pm – 4:35 pm | Venture investing and generating alpha in turbulent times

- Seamon Chan, Co-Founder and Managing Partner, Palm Drive Capital

- Helen Wong, Managing Partner, AC Ventures

- Jessica Huang Pouleur, Partner, Openspace Ventures

- Yinglan Tan, CEO & Founding Managing Partner, Insignia Ventures Partners

- Kristie Neo, Senior Writer, DealStreetAsia (Moderator)

4:35 pm – 5:15 pm | Driving decarbonisation: How the startup ecosystem can take the

- Sui Ling Cheah, Operating Partner, Wavemaker Partners

- Pui Yan Leung, Partner, Vertex Ventures Southeast Asia & India

- Caroline Wee, Investment Partner, Asia, Circulate Capital

- Grace Sai, Co-founder and CEO, Unravel Carbon

- Dylan Loh, Singapore Correspondent, Nikkei Asia (Moderator)

5:15 pm – 5:45 pm | Closing Fireside: GoTo: Scaling up ecosystem integration for

- Catherine Hindra Sutjahyo, Director / Head of Food and Indonesia Sales & Ops, GoTo

- In conversation with Akito Tanaka, Chief business news correspondent, Singapore

- Bureau, NIKKEI & Nikkei Asia

5:45 pm – 7:30 pm | Networking and Cocktails

Virtual Sessions are exclusively curated pre-recorded sessions and will only

be sent to participants with a valid registration for the Asia PE-VE Summit

2022 in Singapore. These content sessions will be sent via email, post-event,

to registered participants only. These sessions are not sold individually at a

separate price for viewing.

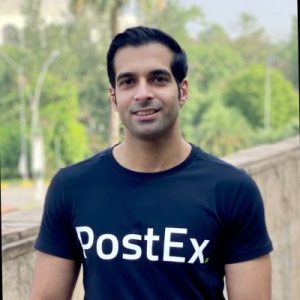

Virtual Session 1 | Pakistan’s long-term investment potential intact despite funding

- Faisal Aftab, Co-Founder, Zayn Capital

- Misbah Naqvi, General Partner & Co-Founder, i2i Ventures

- Omer Khan, Founder, PostEx

- Halima Iqbal, CEO and Founder, Oraan

- Ariba Shahid, Contributor, Pakistan, DealStreetAsia (Moderator)

Virtual Session 2 | Fireside Chat: Investment & exit opportunities for private equity in India – The road ahead

- Satish Chander, Partner, True North

- In conversation with Paramita Chatterjee, Editor, DealStreetAsia

Virtual Session 3 | From unicorn frenzy, the balance tilts to sustainable business models

- Sanjeev Bikhchandani, Founder, Info Edge India

- Mandar Dandekar, Partner, Sorin Investments

- Sameer Brij Verma, Managing Director, Nexus Venture Partners

- Paramita Chatterjee, Editor, DealStreetAsia (Moderator)

Virtual Session 4 | Fireside Chat: Top concerns & focuses for China VCs as they up

- Chibo Tang, Managing Partner, Gobi Partners

- Eudora Wang, Senior Reporter, DealStreetAsia (Moderator)

Virtual Session 5 | Fireside chat: Balanced growth & governance focus are key to building

- Shailendra Singh, Managing Director, Sequoia Capital India Advisors

- In conversation with Joji Thomas Philip, Founder & Editor-in-Chief, DealStreetAsia

Official Venue

9 Wallich Street, Singapore 078885

Wallich Ballroom

HOW TO GET THERE?

1) TRAIN / MRT

Take the green line and alight at Tanjong Pagar Station. Upon exit at the ticket gantry, proceed to Tanjong Pagar Centre’s glass elevators for direct access to the hotel on Level 5 or proceed to Exit A to arrive at the hotel’s arrival lobby located at Peck Seah Street.

2) PRIVATE VEHICLES / TAXI

Enter by the hotel driveway, situated near the entrance of Peck Seah Street.

3) LIMOUSINE SERVICE

Airport limousine transfers can be arranged from $150+/way. A $15 surcharge is applicable for bookings between 11pm and 7am. Advance bookings are encouraged.

4) PARKING FACILITY

Available at Guoco Tower Carpark B, at prevailing car park fees, surcharges may apply for selected dates. Click here for latest parking charges.

Tickets & Promos

Register Now

COMPLIMENTARY TICKETS

APPLICATION IS NOW CLOSED!

Thank you for those who have applied and we look forward to seeing you at our summit soon!

Summit Sponsors

PAST SUMMIT SPONSORS & PARTNERS

Find the best-suited sponsorship opportunity for your brand.

Certified by the CPD Certification Service

Asia PE-VC Summit is now a CPD certified event

For further information on CPD accreditation, please visit www.cpduk.co.uk

About the Summit

In its seventh year now, Asia PE-VC Summit is where you’d want to be for the most well-rounded conference experience for the investment and startup community alike. So far, the annual summit has drawn over 4000 attendees from 50 plus countries, the majority of whom are senior executives.

Stay ahead of the curve as our topline sessions offer you exclusive insight into the next big opportunity. Build relationships with professionals at the top of their game as we make available to you our growing list of 600+ attendees. And, zero in on trends and sectoral bets in Asia’s constantly evolving markets against the pandemic backdrop.

Deep dive into current landscape and a functional roadmap for the year ahead

Get LP & GP perspectives on the challenges and opportunities for PE & VC firms in SE Asia, India and Greater China

Exploring the potential of spotlight countries in the region such as Indonesia & Vietnam

A chance to network with an audience of leaders in the investment & start-up community

Past Event Highlights

Indonesia PE-VC Summit 2022

Southeast Asia’s tech sector enters golden age with accelerated digital adoption

Indonesia PE-VC Summit 2022

SE Asia’s macro trends point to a long runway for growth in tech

Strong capital structures, liquidity and credit access key to navigate the crisis

The art and science of making PE investments during crisis times

Asia PE VC Summit 2020

The road ahead for Gojek

Held In

Your Singapore Guide

GETTING IN

Singapore’s Changi Airport is one of the busiest and best connected in the world, handling over 100 airlines flying to some 400 cities. The airport is also home to Singapore Airlines, the flag carrier of Singapore. Together with Scoot, both airlines fly to more than 135 destinations globally.

The award-winning airport itself is jam-packed with activities and amenities, making it a world-class attraction in its own right.

〉Changi Airport

〉Singapore Airlines

GETTING AROUND

Singapore’s public transport system is fast and efficient.

Get a Singapore Tourist Pass (STP), a special EZ-Link stored-value card which will allow you unlimited travel for one day (S$10), two days (S$16) or three days (S$20).

You can also use your foreign-issued Mastercard® and Visa contactless bank cards issued outside of Singapore for the payment of public transport fares in Singapore. Foreign admin fee applies, please refer to TransitLink’s SimplyGo website for more information.

〉More Info